Bulls may extend consolidation before resuming; US crude stocks data eyed for fresh signal

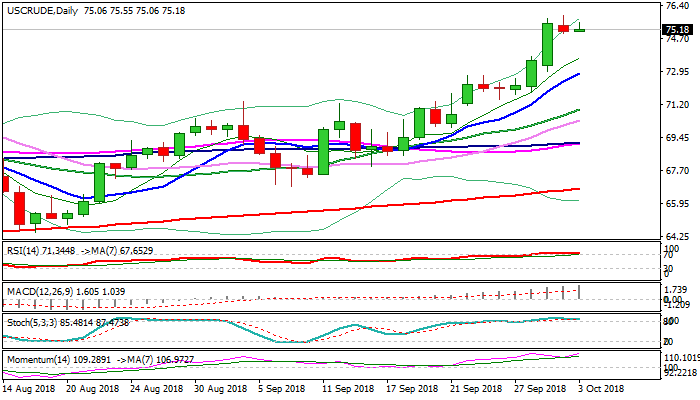

WTI oil price rose on Wednesday after shallow dip to $75 previous day, but remains under new four-year high at $75.89, posted yesterday.

Overall sentiment is bullish, as concerns about the impact on US sanctions on Iran rise and keep markets volatile. Fears of tighter oil market on supply shortage from Iran and Venezuela support price, which trades near the highest levels since late 2014 and bulls eye key double-Fibo barrier at $76.35/39 (Fibo 61.8% of $107.45/$26.04 / Fibo 138.2% expansion of the wave C from 66.85, 07 Sep trough).

Bulls were so far slightly impacted by repeated rise in US crude stocks (API report on Tuesday showed build of 0.90 million barrels vs previous week’s build of 2.9 million barrels), with forecast for today’s EIA report for 1.98 million barrels build vs previous week’s build of 1.85 million barrels.

Stronger than expected build in crude inventories could delay bulls further, with extended dip to be seen as positioning for fresh advance, as bullish daily techs support scenario.

Extended pullback should find ground above $72.90 (rising 10SMA / Tuesday’s low) to keep bulls intact.

Res: 75.34; 75.89; 76.35; 77.00

Sup: 74.92; 74.67; 73.76; 72.90