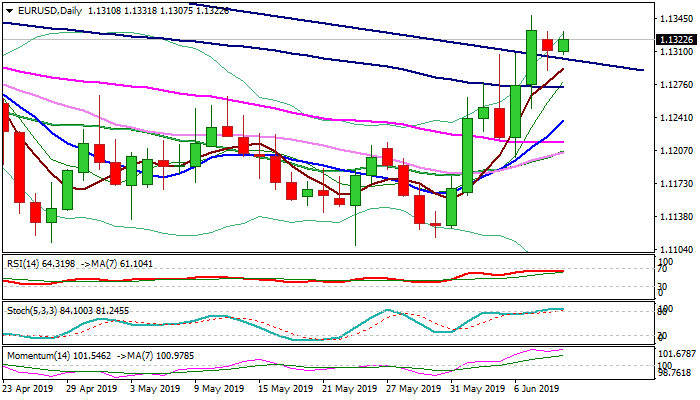

Bulls may show further hesitation to attack 200SMA barrier

The Euro regained traction and heads up in early European trading on Tuesday, after Monday’s dip was strongly rejected and daily action closed above broken bear-trendline off 1.1569 (2019 high) at 1.1305.

Near-term action is supported by daily cloud top and 100SMA and maintains strong bullish momentum, keeping in focus key barrier at 1.1366 (200SMA).

Break here would signal further advance towards 1.1400 (round-figure) and key 1.1448 resistance (20 Mar high).

Bulls may show further hesitation to continue as daily stochastic is overbought and extended consolidation might be likely near-term scenario.

Bullish bias is expected to remain intact while the price holds above daily cloud top (1.1279).

Res: 1.1331; 1.1347; 1.1366; 1.1400

Sup: 1.1302; 1.1290; 1.1279; 1.1272