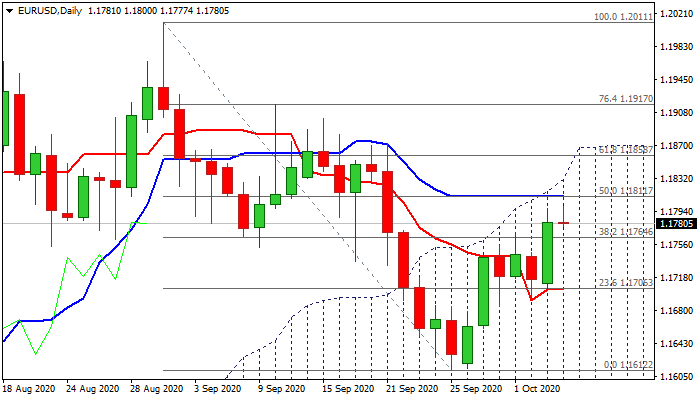

Bulls need lift above daily cloud top for confirmation

The Euro keeps positive tone and pressures 1.1800 barrier in early Monday, following Monday’s 0.6% advance on fresh risk appetite, with President Trump’s return to White House, further lifting the mood.

Upbeat German Factory Orders data showed significant rise in orders for German-made goods (Sep 4.5% vs 2.6% f/c and upward revised Aug figure to 3.3%) add to positive sentiment.

Technical studies support the action as momentum is rising and 10/20DMA’s are in bullish setup.

Monday’s close above pivotal barrier at 1.1764 (20DMA / Fibo 38.2% of 1.2011/1.1612) generated positive signal and long bullish daily candle underpinning the action, however bulls need clear break above 1.1830 (top of thick ascending daily cloud) to neutralize existing risk of stall, while holding within the cloud and open way for further retracement of 1.2011/1.1612 pullback.

Broken pivot at 1.1764 now marks solid support which needs to hold and keep fresh bulls in play.

Res: 1.1811; 1.1830; 1.1858; 1.1870

Sup: 1.1764; 1.1748; 1.1710; 1.1684