Bulls need to clear Fibo barrier at 92.52 to signal continuation; US CPI and Fed Powell testimony to provide direction signals

The US dollar regained traction on Monday after 0.66% drop in past two days.

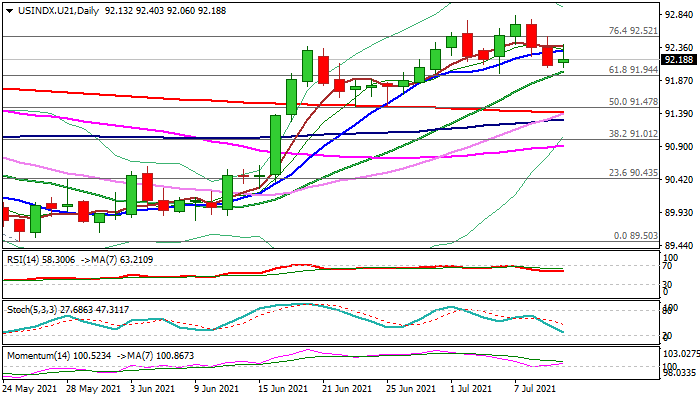

The pullback from new three-month high (92.82) was so far shallow, keeping intact the uptrend from 89.50 (May 25 low).

A significant decrease in dollar’s net short position underpins the action and boosts hopes for further squeeze of shorts from late March top (93.45).

Bullish setup of daily MA’s and fresh positive momentum are supportive, but bulls need clear break of pivotal Fibo resistance at 92.52 (76.4% of 93.45/89.50 fall), where the action repeatedly stalled, to signal bullish continuation and expose key barrier at 93.45 (Mar 31 high).

Pivotal supports at 92.00 zone (rising 20DMA / Fibo 23.6% of 89.50/92.82) need to hold to keep bulls intact, while break lower would weaken near-term structure and risk dip towards key 91.50/40 support zone (200DMA / Fibo 38.2% of 89.50/92.82).

Tuesday’s US inflation data and Fed Chair Powell’s testimony on Wednesday will be closely watched for more clues about the outlook for US inflation and pace and timing of Fed’s future policy tightening that would generate stronger direction signal for the greenback.

Res: 92.32; 92.52; 92.82; 93.11

Sup: 92.00; 91.89; 91.60; 91.32