Bulls pause after strong rally, awaiting UK PMI data for fresh signals

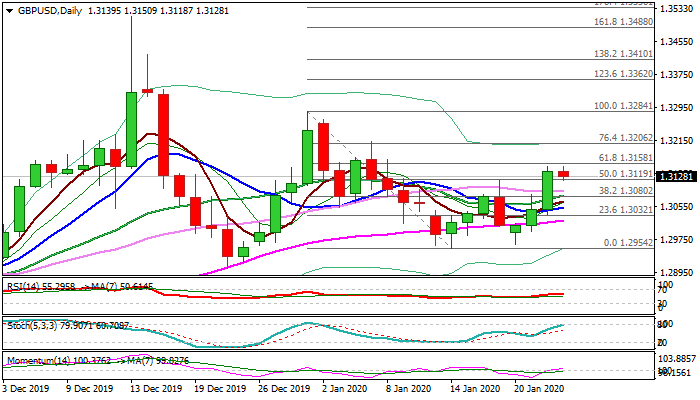

Cable eases after three-day rally which repeatedly failed under pivotal Fibo barrier at 1.3158 (61.8% of 1.3284/1.2954).

Wednesday’s 0.7% advance marks the biggest one-day rally since 31 Dec, fueled by better than expected data (CBI index rose the highest in nearly six-years, with current easing seen as corrective action on overbought stochastic, as near-term action is underpinned by daily MA’s in bullish setup and rising momentum entering positive territory.

Corrective dips should find ground above converging 30/20DMA’s (1.3090/80 respectively and in attempt to form bull-cross) in order to keep bulls in play for renewed probe through 1.3158 and attack at next significant barrier – daily cloud top (1.3199).

Traders turn their focus to UK PMI data, due on Friday, which could provide fresh boost to sterling and reduce risk of BoE rate cut if releases beat forecasts.

Res: 1.3158; 1.3199; 1.3206; 1.3265

Sup: 1.3118; 1.3090; 1.3080; 1.3051