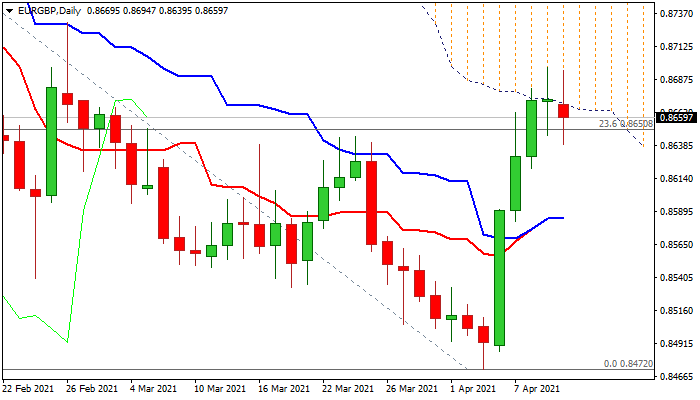

Bulls pause under massive daily cloud ahead of UK GDP

The cross is consolidating after last week’s 2% rally, as bulls faced strong headwinds at the base of thick falling daily cloud (0.8670)

Repeated penetration into cloud failed to register a close within the cloud and it’s unlikely that today’s attempt will succeed.

Friday’s action ended in long-legged Doji, with similar patter seen today that reinforces signal of strong indecision.

Massive daily cloud produces strong pressure, with fading bullish momentum and overbought stochastic, generating an initial signals of pullback.

Close below 55DMA (0.8653) which so far holds, is seen as minimum requirement to verify reversal signal.

Traders focus on tomorrow’s release of UK GDP data which could give more hints about near-term direction.

Below 55DMA, next pivotal support lays at 0.8611 (Fibo 38.2% of 0.8472/0.8697 upleg) and firm break here would add to reversal signals.

Conversely, break into daily cloud would signal fresh weakness of sterling and expose barriers at 0.8730/61 (Feb 26 spike high / Fibo 38.2% of 0.9229/0.8472 downtrend).

Res: 0.8670; 0.8700; 0.8730; 0.8761

Sup: 0.8650; 0.8611; 0.8584; 0.8577