Bulls penetrate daily cloud, boosted by strong data and weaker greenback

The Australian dollar advanced further in early Friday’s trading, boosted by Australian retail sales data (Nov 0.4% vs 0.3% f/c).

Weaker US dollar on repeatedly dovish tone from Fed chief Powell, which made investors more confident that US central bank’s rate hike cycle would stay on hold in 2019.

Also, optimism about agreement between the US and China over trading dispute, despite talks in past three days ended without deal, continues to fuel risk appetite and underpin the Aussie dollar.

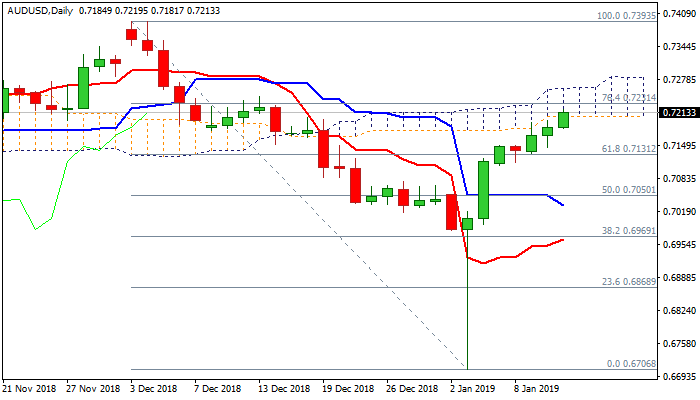

Fresh bulls broke above converged 55/100SMA’s and penetrated daily cloud (spanned between 0.7207 and 0.7260).

Immediate target at 0.7231 (Fibo 76.4% of 0.7393/0.6706) is under pressure, with extension above daily cloud, expected to generate fresh bullish signal and unmask 200SMA (0.7334).

Strengthening bullish momentum and daily MA’s turning to positive setup continue to underpin, with the pair being on track for the second straight bullish weekly close.

On the other side, strongly overbought slow stochastic require caution.

Broken 55/100SMA’s mark initial support at 0.7180, with deeper dips expected to find ground above broken Fibo 61.8% barrier at 0.7131 to keep bulls intact.

Res: 0.7231; 0.7246; 0.7260; 0.7334

Sup: 0.7180; 0.7160; 0.7131; 0.7109