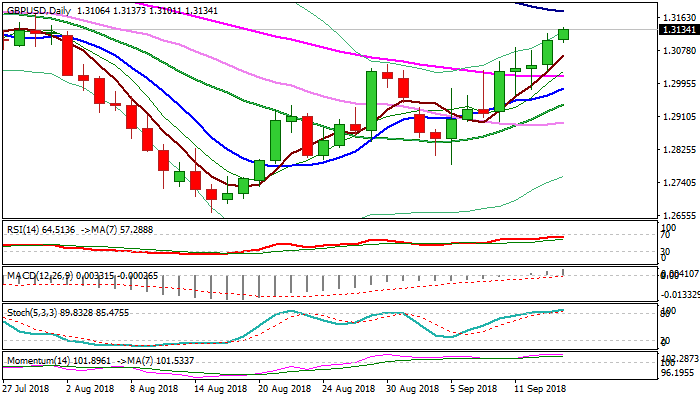

Bulls probe above daily cloud and focus Fibo / 100SMA bariers at 1.3162/77

Cable remains firm and extends higher after strong rally on Wednesday, pressuring top of falling daily cloud (1.3145) and focusing key barriers at 1.3162/79 (Fibo 61.8% of 1.2472/1.2661 descend / falling 100SMA).

Sterling showed little reaction on BoE’s decision to keep rates unchanged and cautious stance until Brexit talks end, but rallied strongly after the dollar was hit by weaker than expected US CPI data.

Growing optimism over final deal for Brexit adds to pound’s positive outlook, supported by bullish daily technical studies, however, bulls may take a breather on overbought conditions.

Bulls need weekly close above falling daily cloud and break through 1.3162/79 pivots, to generate stronger signal for continuation of larger uptrend from 15 Aug low at 1.2661.

Speech of BoE’s Governor Carney is the highlight of the European session, while US retail sales will be in focus during the US trading.

Session low at 1.3101 marks initial support, followed by rising 5SMA (1.3066) and key support at 1.3011 (55SMA).

Res: 1.3145; 1.3162; 1.3179; 1.3213

Sup: 1.3101; 1.3066; 1.3043; 1.3011