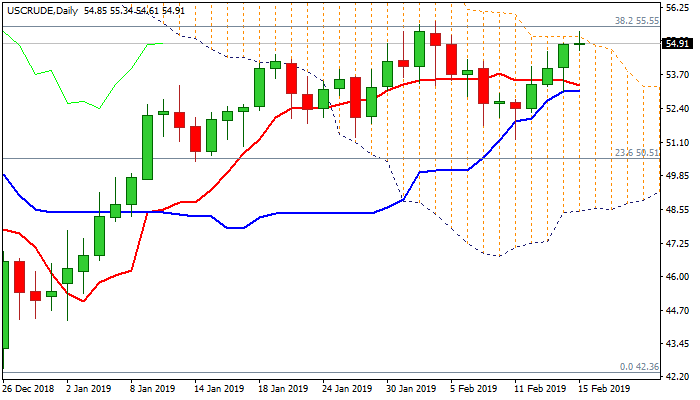

Bulls probe above daily cloud as OPEC production cut underpins oil prices

WTI oil price cracked the top of falling daily cloud ($55.15) on Friday, extending advance into fourth straight day.

Voluntary production cut by OPEC members and their allies in order to tighten oil market, started giving results, with signals for increased reduction by over half a million bpd in March, adding to positive outlook.

Also, partial closure Saudi Arabia’s biggest offshore oilfield, provided additional boost to oil prices.

Bullish daily techs remain supportive for renewed attack at $55.55 Fibo barrier and $55.73 (2019 high posted on 4 Feb), break of which would expose falling 100SMA ($57.24).

Initial bullish signal could be expected from close above cloud top, however, bulls may show hesitation on approach to $55.55/73 barriers as daily stochastic is overbought.

Converged daily 10/20SMA’s ($53.71/53) offer solid support, which is expected to contain extended downticks and keep immediate bulls intact.

Res: 55.15; 55.55; 55.73; 57.24

Sup: 54.61; 53.71; 53.53; 53.07