Bulls probe again through 112 barrier as solid US data boost dollar

The pair rose to session high at 112.03 in early US trading on Wednesday following stronger than expected US data.

US services sector picked up in Feb (ISM Non-Manufacturing PMI rose to 59.7 after slowing down in Jan and beating forecast at 57.3) while new home sales rose to the highest since July 2018 (Feb 621K vs 600K f/c; 599K Jan).

The dollar appreciated on solid data that reduce risk of slowdown in economic growth and brighten the outlook for the Fed, after central bank signaled that it will likely slowdown its interest rate hikes in 2019.

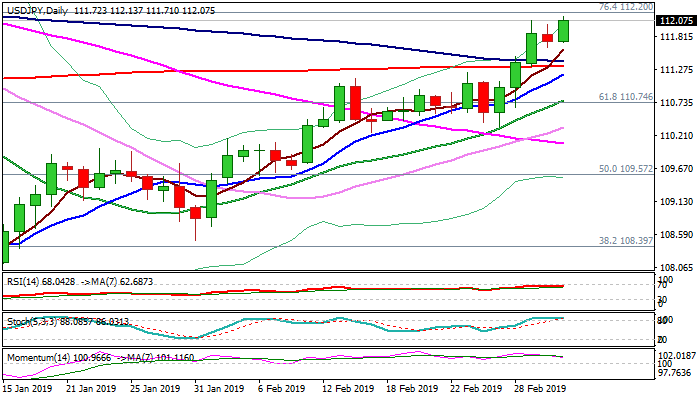

Although fresh bulls probed again above 112 handle, key barriers at 112.20/31 (Fibo 76.4% of 114.54/104.59 / 200WMA) remain intact, but under increasing pressure.

With near-term action being also underpinned by thick hourly cloud, bulls show scope for eventual break higher that is expected to spark stronger bullish acceleration on break above pivotal barriers and activating stops, parked above.

Rising 5SMA continues to track advance (111.59) and guards key supports at 111.41/18 (converging 100/200SMA’s).

Res: 112.20; 112.31; 112.60; 112.88

Sup: 111.88; 111.61; 111.41; 111.34