Bulls regain traction but need close above daily cloud for initial positive signal

The pair holds bid tone on Monday as global gradual re-opening elevates risk that increases pressure on yen.

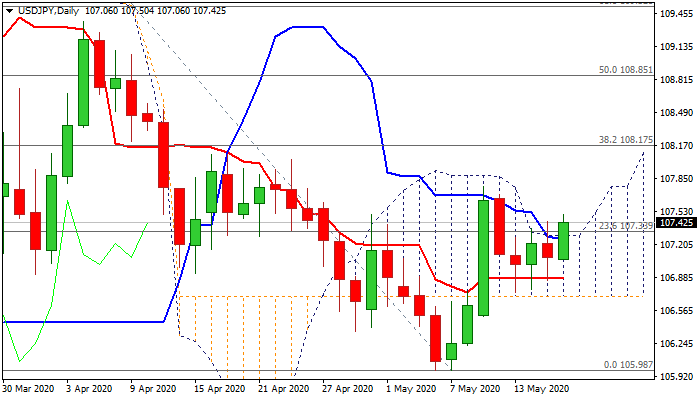

Fresh strength after three days in narrow range trading (held by 10DMA) probes above daily cloud which narrowed these days, but will start to thicken from Wednesday and expected to underpin the action, if bulls manage to close above cloud top (107.25) and clear another pivotal barrier, provided by 55DMA (107.52).

Break above the top of four-day range would open way for extension towards 108.17 (Fibo 38.2% of 111.71/105.98) and 108.24/44 (converging 200/100 DMA’s)

Rising bullish momentum and RSI ascending above neutrality zone, add to positive signals, however, risk of extended directionless mode could be expected on failure to break 107.25/52 barriers.

Res: 107.52; 108.04; 108.17; 108.24

Sup: 107.05; 106.89; 106.70; 106.51