Bulls regain traction but need further signals for extension

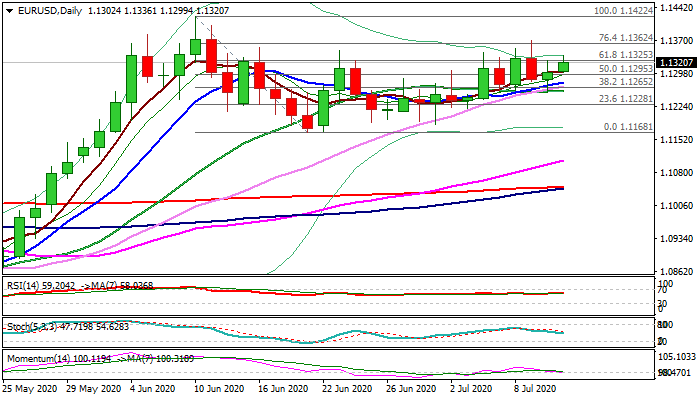

The Euro extends recovery on Monday following Friday’s positive close after the action was contained by daily Tenkan-sen for the fourth straight day.

Fresh advance partially offsets negative impact from last week’s bull-trap and turns focus higher again, but needs more evidence to signal bullish continuation.

Near-term action remains underpinned by rising 10/20/30DMA’s, but weakening momentum and south-heading stochastic on daily chart and rising negative momentum on 4-hr chart, warn of stall.

Weaker dollar adds to Euro’s strength, but bulls need close above cracked Fibo barrier at 1.1325 (61.8% of 1.1422/1.1168) to generate bullish signal for renewed attack at 1.1362 (Fibo 76.4%) and possible extension to 1.1400 zone on break.

Session low at 1.1300 (reinforced by 5DMA) marks initial support, guarding pivotal support at 1.1277 (10DMA) and lower breakpoint at 1.1257 (20DMA).

Res: 1.1325; 1.1336; 1.1362; 1.1400

Sup: 1.1300; 1.1277; 1.1257; 1.1228