Bulls return to play but caution on possible repeated upside rejection

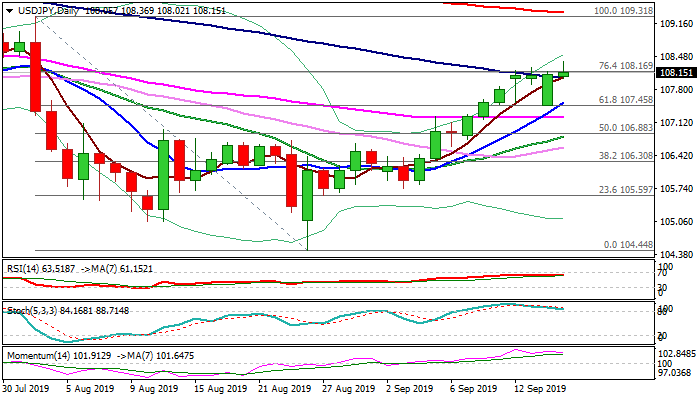

Bulls returned to play and probe again through pivotal barriers at 108.04/16 (100DMA / Fibo 76.4% of 109.31/104.44), following short-lived pullback to 107.46 and subsequent rebound.

The dollar regained traction after being hit by risk aversion on geopolitical tensions, but traders turn focus towards Fed’s policy decision on Wednesday, which is seen as key market driver.

Renewed upside attempts are still struggling to break higher and risk of repeated failure exists, as weakening momentum and stochastic reversing in overbought territory warn, with tomorrow’s daily cloud twist (107.18) adding to concerns.

Bearish scenario would require return and close below 107.51/46 (10DMA / Tuesday’s low) for activation, with extension below 107.22 (55DMA) needed to generate stronger bearish signal and shift near-term focus lower.

Eventual break and close above 108.04/16 pivots would confirm bulls and unmask next key barriers at 109.31/36 (1 Aug high / Fibo 61.8% of 112.40/104.45).

Res: 108.36; 108.42; 108.95; 109.36

Sup: 108.02; 107.90; 107.46; 107.22