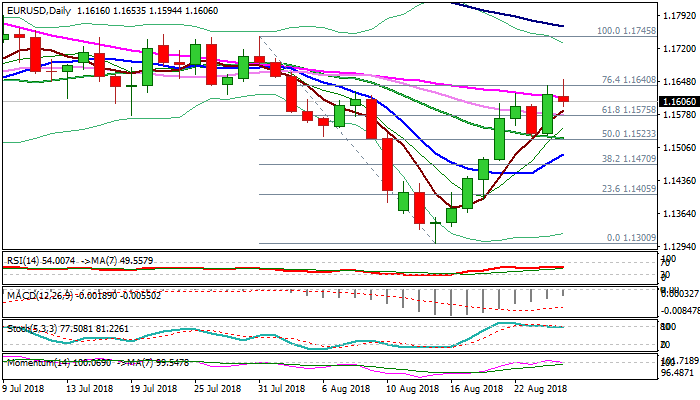

Bulls show hesitation at daily cloud base

The Euro moved lower at the beginning of the European session after hitting four-week high at 1.1653 in Asia, as the greenback opened lower on Monday after Fed chief Powell’s speech on Friday was seen less hawkish than expected and disappointed dollar bulls.

Rally from 1.1300 (15 Aug low) showed initial signs of stall on approach to daily cloud base (1.1659) as cloud (spanned between 1.1659 and 1.1752) marks significant obstacle.

Daily studies support negative scenario as slow stochastic reverses from overbought zone and 14-d momentum turns south and entering negative territory.

On the other side, Friday’s long bullish daily candle, which also formed outside day pattern, underpins near-term action, with break through daily cloud needed to signal stronger advance.

Broken 30SMA (1.1576) marks important support (reinforced by bull-cross with rising 5SMA) which should ideally hold to keep bulls intact.

Deeper dips would challenge key supports at 1.1530 zone (20SMA / Thu/Fri lows) los of which would signal reversal.

German Ifo data are key event for Euro on thin Monday’s calendar.

Forecast for Aug release (101.9) is slightly better than July’s figure (101.7), however, the index stands at the lowest since Oct 2012 and needs stronger results to generate positive signal.

Res: 1.1659; 1.1700; 1.1752; 1.1790

Sup: 1.1594; 1.1576; 1.1526; 1.1491