Bulls stalled again under strong 0.72 resistance after downbeat Australian data

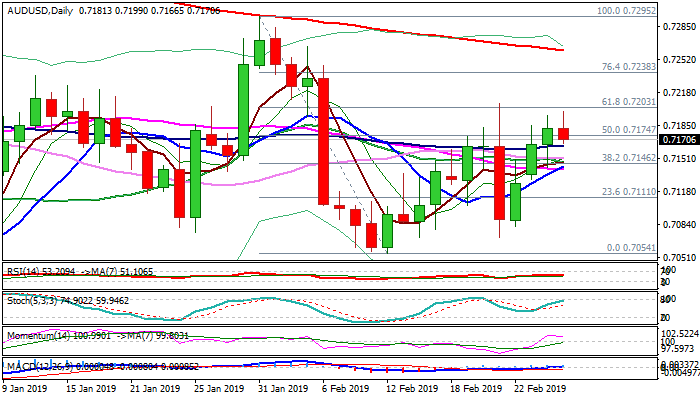

The Australian dollar holds in red on Wednesday as three-day rally faced again strong headwinds from pivotal 0.72 resistance zone (Fibo 61.8% of 0.7295/0.7054) where recovery already stalled last week.

Downbeat Australian construction data (Q4 -3.1% vs 0.6% f/c) add to negative near-term tone.

Bulls are losing momentum but hold for now above broken 100SMA (0.7163) that keeps positive near-term bias, also boosted by optimism on US/China trade talks.

Extended dips need to hold above a cluster of daily MA (0.7150/40 zone) to keep focus at the upside, as overall picture is positive and favors further advance.

Eventual break above 0.72 zone would expose Fibo barrier at 0.7238 (76.4% of 0.7295/0.7054) and more significant 200SMA (0.7260) and 2019 high (0.7295).

Only return and close below 0.7140 would sideline near-term bulls and risk further easing.

Res: 0.7203; 0.7238; 0.7260; 0.7295

Sup: 0.7163; 0.7142; 0.7111; 0.7082