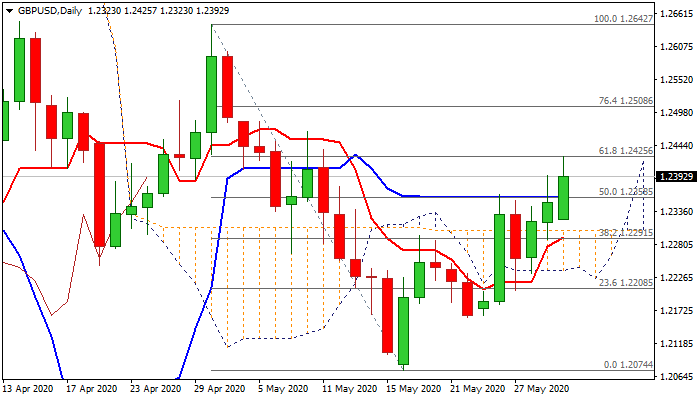

Rally takes a breather under key Fibo resistance at 1.2425

Cable maintain bullish tone on Monday and hit three-week at 1.2425 in European trading but pulled back to 1.2380 zone after rally was capped by Fibo barrier at 1.2425 (61.8% of 1.2642/1.2074).

Weak dollar and UK’s manufacturing PMI in line with expectations (40.7) and well above previous month’s 32.6 figure, adds to positive tone.

Bullish setup of daily 10;20;30;55 DMA’s and rising positive momentum, underpin the action, but rally may pause for consolidation before resuming.

Broken daily Kijun-sen / 50% of 1.2642/1.2074 (1.2358) should ideally contain but dips towards daily cloud top (1.2304) cannot be ruled out.

Reversal above cloud top would keep bulls in play for renewed attack at 1.2425 pivot, break of which would open way for 1.25+ gains.

Caution on return and close below cloud top that would signal recovery stall.

Res: 1.2425; 1.2467; 1.2484; 1.2508

Sup: 1.2358; 1.2304; 1.2291; 1.2243