Cable – bulls hold grip ahead of key US data

Cable jumped above 1.3400 mark on Tuesday morning after better than expected December Manufacturing and Services PMIs (preliminary) offset weak numbers from labor report.

Sterling maintains firm tone and holding just under new high in almost two months, ahead of key economic event of the day – releases of combined (Oct/Nov) US labor report, Oct retail sales and Dec preliminary PMIs.

The data (particularly from labor sector) will provide necessary information to the US central bank in shaping their monetary policy in the near future, as markets widely expect another rate cut in January and more dovish stance from Fed.

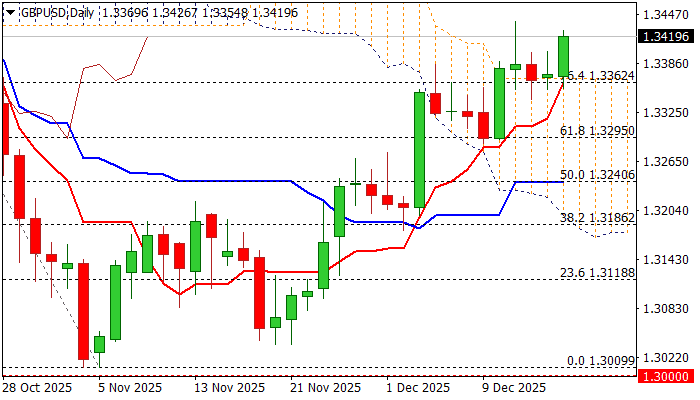

Technical picture is firmly bullish on daily chart, with the price action establishing above the top of very thick and sideways-moving daily cloud, MAs in bullish configuration (with the latest formation of 10/200DMA golden cross, underpinning), though partially countered by fading positive momentum.

Near-term action is expected to remain biased higher while above cloud top (1.3367, reinforced by rising daily Tenkan-sen), with acceleration through Thursday’s spike high (1.3438) to expose 1.3471 (Oct 17 lower top) and 1.3500 (psychological).

Res: 1.3438; 1.3471; 1.3500; 1.3527

Sup: 1.3400; 1.3367; 1.3342; 1.3295