Cable – bulls hold grip ahead of UK GDP data

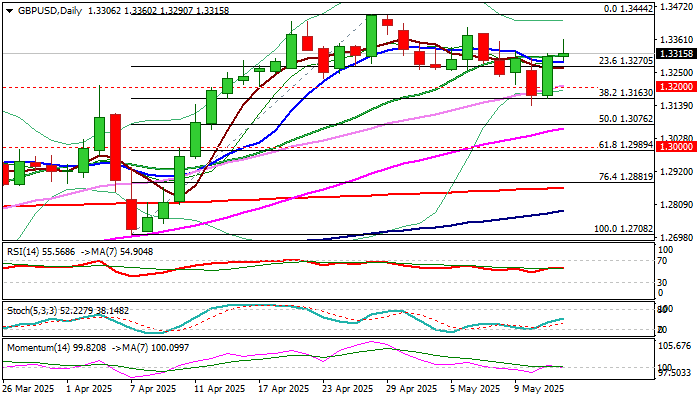

Cable keeps firm near term tone and extends recovery after Tuesday’s 1% rally generated positive signal on over 50% retracement of 1.3444/1.3139 pullback and completion of bullish engulfing pattern on daily chart.

Fresh extension higher on Wednesday rose above Fibo 61.8% retracement that adds to development of reversal signal, after strong bounce on Tuesday signaled that corrective phase from new 2025 high (1.3444) is likely over.

Formation of bear-trap under Fibo 38.2% of 1.3444/1.3139 contributes to positive near-term outlook, along with predominantly bullish daily studies.

Traders focus on tomorrow’s releases of UK GDP data, with expectations for 0.6% growth in Q1 being significantly above 0.1% growth in the first three months of 2024, although economists see flat growth in March compared to 0.5% expansion in the previous month.

Sterling would benefit from better than expected GDP data that would also ease pressure on BOE to cut rates again in June (bets for June cut have dropped significantly after May’s hawkish cut).

Also, a trade deal with the US would ease uncertainty and improve economic situation on removing one of major obstacles for economic growth.

Res: 1.3360; 1.3402; 1.3444; 1.3500

Sup: 1.3270; 1.3232; 1.3200; 1.3162