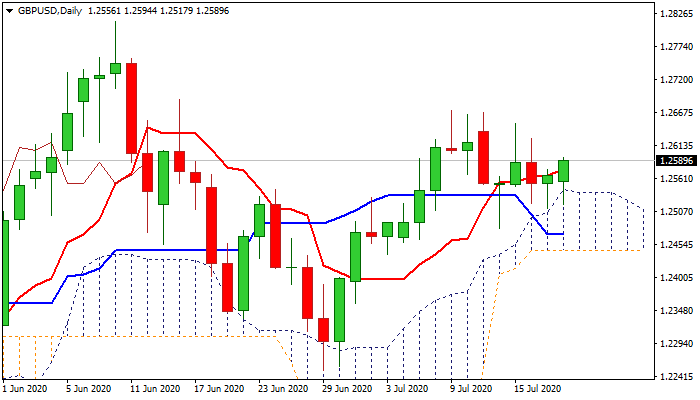

Cable edges higher after daily cloud contained dips but remains within 4-day congestion

Cable jumped on Monday, dragged by stronger Euro and weaker dollar, following last week’s double failure to penetrate daily cloud.

With the downside being so far protected by cloud top (1.2538) and Fibo 38.2% of 1.2251/1.2669 / rising 20DMA (1.2509/04), fresh strength shifts focus towards the upper boundary of congestion, in which the pair holds for the fourth straight day.

Although the pullback from 1.2669 triple-top found solid ground, long shadows of candles in past few days signal indecision.

This may keep the pair in extended range trading and positive signals from daily MA’s in bullish setup are offset by fading positive momentum.

Overall bias is expected to remain with bulls as long as price action stays above 1.2509/04 pivots, but repeated rejections under 1.2669 zone tops would soften near-term tone.

Initial barriers lay at 1.2624/40 (spike highs of last Fri/Thu) which guard more significant 1.2669 high at 200DMA (1.2696).

Res: 1.2594; 1.2624; 1.2640; 1.2669

Sup: 1.2570; 1.2538; 1.2517; 1.2509