Cable extended weakness after another upside rejection; UK labor data add to fresh pressure

Cable holds in red on Thursday and dips to two-day low after strong upside rejection on Wednesday generated negative signal.

UK Jobs and earnings data added pressure on pound as data released today did not include the most recent movements in UK labor sector that worries investors as analysts see today’s figures as a clam before the storm, on strong impact of coronavirus to the economy.

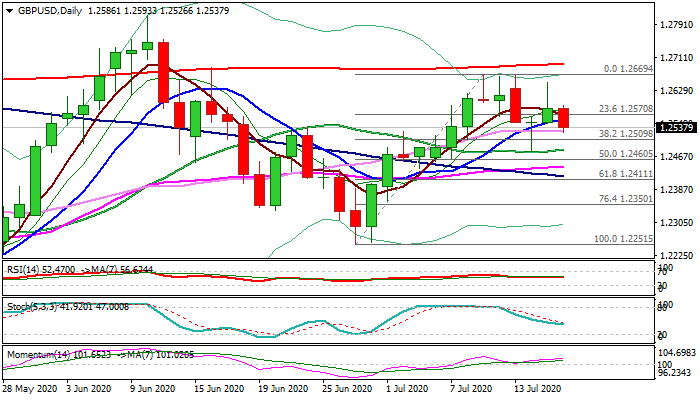

Weakened sentiment after failure to complete reversal pattern on Wednesday and open way for retest of key barriers 1.2665 zone, weighs on pound.

Fresh weakness cracked 30DMA (1.2529) and eyes pivotal supports at 1.2509/05 (Fibo 38.2% of 1.2251/1.2669 / daily cloud top), break of which would spark deeper pullback and generate initial reversal signal after triple-top was left at 1.2665 zone.

Mixed daily techs lack clearer signal and traders will focus on today’s release of a batch of US economic indicators.

Res: 1.2570; 1.2595; 1.2600; 1.2649

Sup: 1.2529; 1.2509; 1.2485; 1.2460