Cable extends advance on improved sentiment over Brexit; UK jobs data in focus

Sterling accelerates higher in early European trading on Tuesday, following narrow consolidation of Monday’s strong rally in Asia.

The sentiment improved after top EU Brexit negotiator said on Monday that the deal could be struck in the coming weeks, calming fears about scenario on disorderly no-deal Brexit.

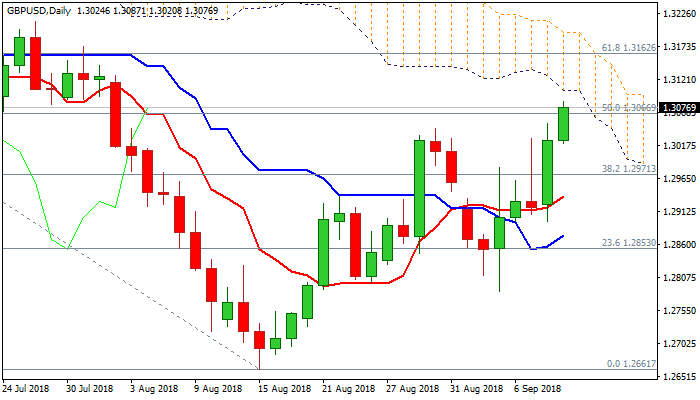

Extension of Monday’s 0.8% advance which generated bullish signals on close above falling 55SMA and former high of 30 Aug (1.3043), hit new high at 1.3087, the highest since 02 Aug, on probe through 1.3066 barrier (50% of 1.3472/1.2661) and eye the base of falling daily cloud at 1.3104, as the cloud is thin and expected to attract further advance.

Daily techs turned to full bullish configuration and support the notion, however, bulls may take a breather on approach to cloud base as daily slow stochastic is entering overbought territory.

Broken 55SMA now marks solid support (1.3014) which is expected to ideally keep the downside protected.

Release of UK jobs data is in focus today, with jobless claims forecasted higher in August (10K f/c vs 6.2K previous month), while average earnings forecast for 2.4% increase in August is unchanged from the previous month.

Better than expected figures today would provide additional tailwind to the pound.

Another key event this week, BoE’s monetary policy decision, due on Thursday, is also coming in focus, with wide expectations that the policymakers would leave their policy unchanged.

Res: 1.3087; 1.3104; 1.3162; 1.3196

Sup: 1.3043; 1.3014; 1.3000; 1.2970