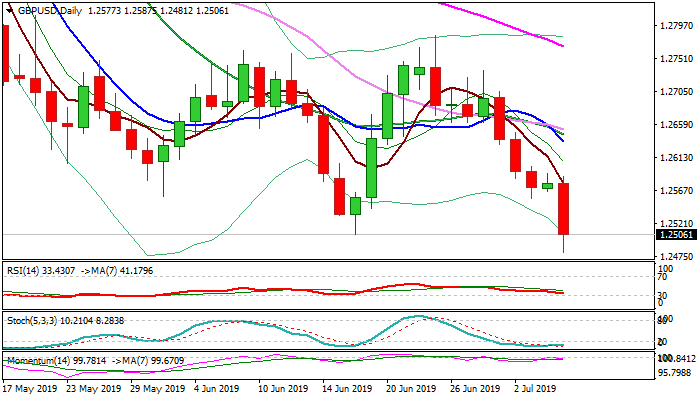

Cable hit new six-month low on post US data bearish acceleration

Cable fell to six-month low after stronger than expected US NFP data and is on track for the biggest one-day loss since 28 Mar.

The pair broke through key support at 1.2505 as big NFP beat sidelined risk of 0.5% rate cut in July that inflated the greenback.

Fresh bears came ticks ahead of strong supports at 1.2479/76 (11/12 Dec lows), break of which would open way for full retracement of 1.2397/1.3381 (2019 low / high) ascend.

Bearish daily / weekly studies and existing fears of no-deal Brexit maintain negative sentiment and keep sterling under pressure.

Weekly close below 1.2505 is needed to confirm scenario, however, bears may slow before breaking 1.2479/76 pivots, as traders may book profits after strong fall.

Upticks are expected to provide better opportunities for entering bearish market and should be ideally capped at 1.2600 zone.

Res: 1.2556; 1.2577; 1.2611; 1.2643

Sup: 1.2505; 1.2476; 1.2440; 1.2397