Cable – limited correction likely to precede fresh rise, US labor data in focus

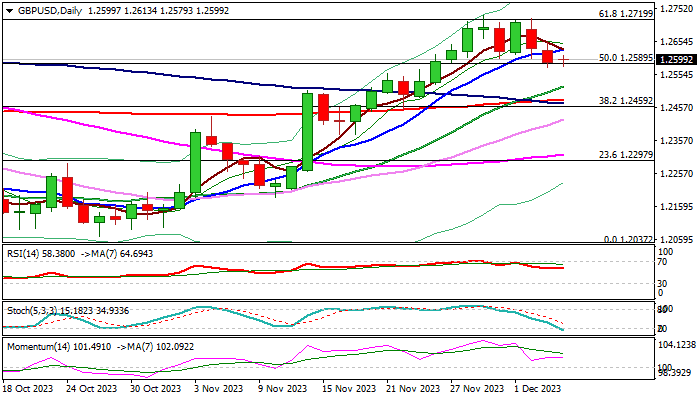

Cable is holding within a tight range on Wednesday morning, as two-day pullback found a footstep on broken Fibo support at 1.2585, though stronger dollar and weaker than expected UK data continue to sour the sentiment.

Traders await release of US labor data (ADP report is due later today and NFP on Friday) for fresh direction signals.

Technical studies on daily chart are bullishly aligned (positive momentum / MA’s mainly in bullish setup / oversold stochastic) which points to scenario of limited correction preceding fresh push higher.

Extended dips should hold above rising 20DMA (1.2518) and should not exceed 200DMA (1.2479) to keep short-term action biased higher, with break of recent tops (also Fibo 61.8% of 1.3141/11.2037) which recently capped multiple attacks, to signal bullish continuation.

Res: 1.2631; 1.2700; 1.2719; 1.2746

Sup: 1.2577; 1.2518; 1.2500; 1.2467