Cable loses ground after bulls got trapped above 1.20 barrier

Cable was down almost two full figures from early European to early US session, as UK finance minister unveiled tough budget, which includes tax increases and tighter public spending, while downwardly revised projections warn of prolonged recession.

In addition, hawkish comments from Fed policymaker that the central bank will continue to raise interest rates despite dovish expectations, further soured near-term sentiment.

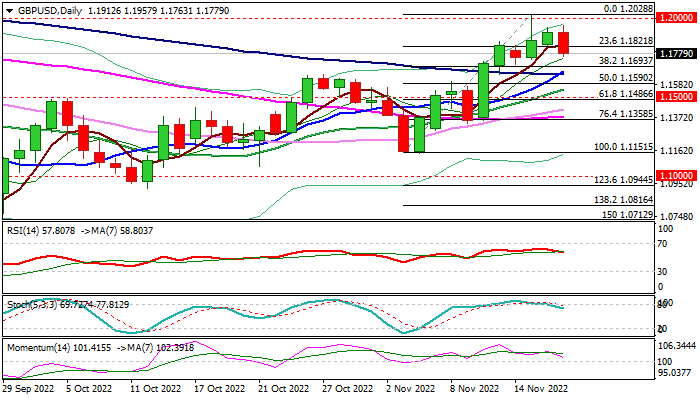

Sterling dipped below broken Fibo level at 1.1834 (76.4% of 1.2293/1.0348), also weighed by signal of bull-trap after failure to sustain gains above psychological 1.20 barrier on Tuesday.

Weakening bullish momentum on daily chart and south-heading stochastic after reversal from overbought territory, contribute to negative near-term outlook, as fresh weakness broke below initial Fibo support at 1.1821 (23.6% of the upleg from 1.1151 higher base to 1.2028 spike high (Nov 15).

Bears eye pivotal supports at 1.1693 (Fibo 38.2%) and 1.1645 (100DMA) violation of which would signal deeper pullback.

Res: 1.1821; 1.1957; 1.2000; 1.2028

Sup: 1.1744; 1.1693; 1.1645; 1.1590