Cable loses traction as US rate talks / rising virus cases offset positive post-NFP tone

Cable is standing at the back foot at the start of the week, following multiple failure to sustain break above 1.42 barrier and dollar regained traction on comments from Fed Treasury Secretary Yellen over the weekend, after it was deflated by weaker than expected US labor data on Friday.

Yellen said that President Biden’s $4 trillion spending plan would boost inflation and contribute to increasing interest rate that would be a positive environment for the US, as the interest rates were to low for a long period of time.

Pound’s sentiment could be further soured by rising concerns about England’s unlocking on June 21 as fresh rise in new cases of Delta variant of coronavirus (Indian).

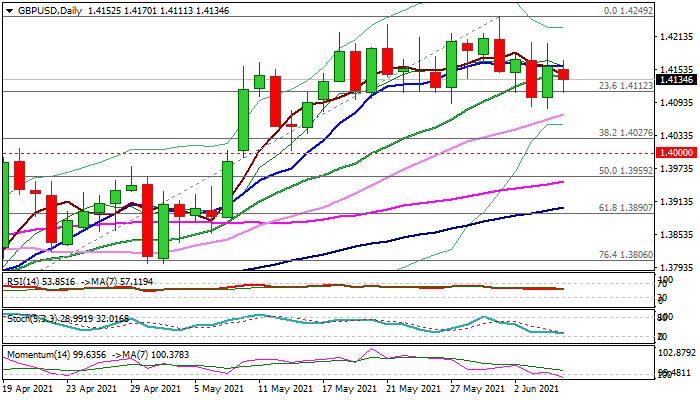

Weaker technical studies on daily chart keep the downside at risk as today’s fresh weakness pressures pivotal Fibo support at 1.4112 (23.6% of 1.3669/1.4249), which kept the downside protected for past three weeks.

Firm break here (after several probes below this level failed to sustain) would weaken near-term structure and risk test of key supports at 1.4027/00 (Fibo 38.2% of 1.3669/1.4249 / psychological) and risk reversal on break.

Near-term action is expected to remain biased lower as long as daily Tenkan-sen (1.4166) caps, while only sustained break above 1.4200 mark would improve the outlook.

Res: 1.4166; 1.4202; 1.4233; 1.4249

Sup: 1.4112; 1.4082; 1.4070; 1.4027