Cable rebounds and cracks daily cloud base on better than expected UK data

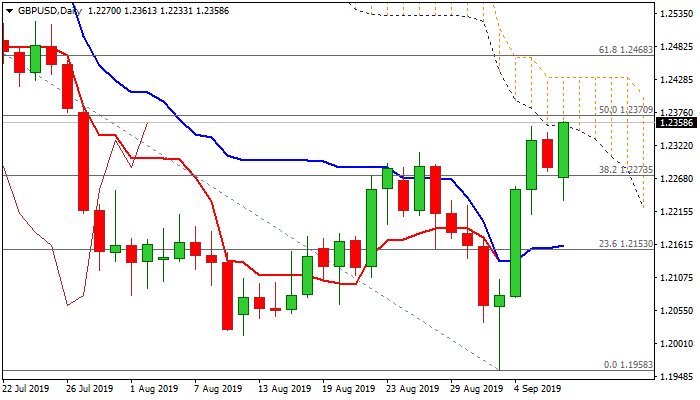

Cable bounced above 1.23 level and probed again above falling 55DMA (1.2328) after pullback stalled above rising 10DMA (1.2218) and better than expected UK data inflated pound.

GDP data showed that Britain’s economy expanded more than expected in July (0.3% vs 0.0% in June), Manufacturing production rose (July 0.3% vs -0.1% f/c) while trade gap narrowed to 9.14B vs forecasted 9.6B.

Solid data reduced fears of Britain’s economy entering recession and renewed optimism among traders inflated sterling for fresh attack at daily cloud base (1.2353).

Fresh bullish momentum on 4-her chart is supporting the advance, which seeks for strong bullish signal on eventual break and close above daily cloud base and attempts through 1.2380 (50% retracement of 1.2783/1.1958 descend) for confirmation.

Bullish engulfing pattern is forming on daily chart and completion would generate fresh signal of bullish continuation.

Caution on repeated failure to clear cloud base that would signal extended sideways mode but also keep the downside vulnerable.

Res: 1.2370; 1.2400; 1.2431; 1.2468

Sup: 1.2328; 1.2300; 1.2260; 1.2233