Cable rises above 1.30 for the first time since mid-July

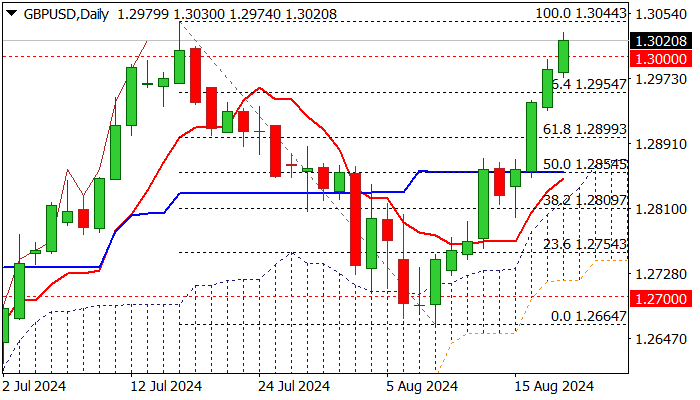

Cable broke above psychological 1.30 level on Tuesday (last probe above this barrier was on July 17/18).

Rally from 1.2664 (Aug 8 low, where rising daily cloud contained previous downtrend and reversed direction) is steep and uninterrupted, holding for the second week.

Daily studies hold strong positive momentum and MA’s in bullish setup, suggesting that bulls hold grip for more gains.

July peak at 1.3044 is under pressure, with firm break here to open way towards 2023 high at 1.3141.

On the other hand, overbought conditions on daily chart may pause rally for consolidation / shallow correction.

Initial supports lay at 1.2974/54, followed by 1.2900 and daily cloud top (1.2860).

Release FOMC Minutes (Wednesday) and Fed Powell’s speech in Jackson Hole (Friday) will be closely watched for fresh signals.

Res: 1.3044; 1.3100; 1.3141; 1.3200

Sup: 1.3000; 1.2954; 1.2900; 1.2860