Cable stands at the back foot but above key supports ahead of BoE rate decision

Cable moved lower in early European session and probed again below 1.30 support after holding within narrow range in Asia.

BoE policy meeting is key event today, with percentage for remaining unchanged being slightly higher from expectations for rate cut.

Sentiment remains negative and weighed by Brexit uncertainty as the Britain is about to leave the EU officially on Friday 31 Jan, with rising fears of spreading China virus, keeping riskier assets aside.

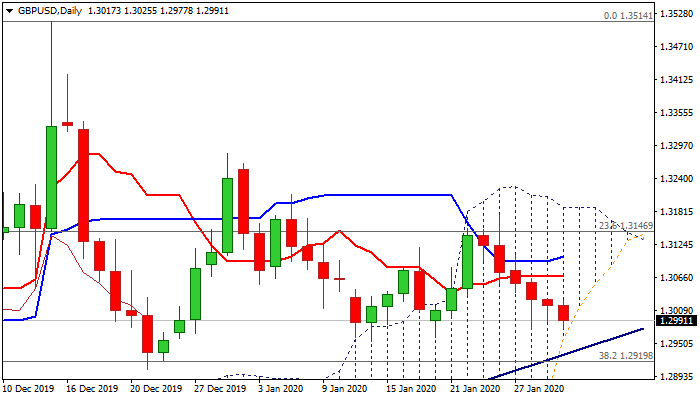

Technical studies on daily chart are in negative setup (rising bearish momentum / multiple MA’s bear-crosses) which adds to negative outlook.

Bears pressure daily cloud base (1.2960) violation of which would generate fresh bearish signal for extension of six-day bear-leg towards next key levels at 1.2937 (trendline support) and 1.2919 (Fibo 38.2% of 1.1958/1.3514 ascend).

Positive reaction on BoE’s decision would require break and close above converged DMA’s at 1.3050/60 zone) to neutralize bears and signal reversal.

Res: 1.3025; 1.3050; 1.3060; 1.3104

Sup: 1.2975; 1.2960; 1.2919; 1.2904