Cable stands at the front foot and looking for clearer direction signals from Fed

Cable regained traction and bounced above 1.2500 mark on Wednesday, lifted by weaker dollar ahead of Fed decision.

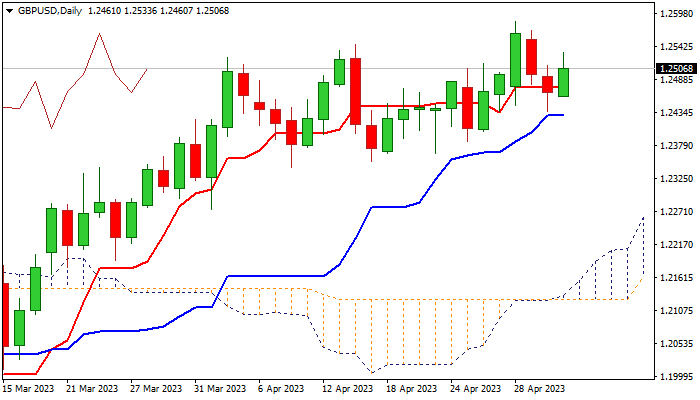

Fresh advance generates initial signal that two-day pullback from new 2023 high (1.2583) might be over, as today’s acceleration retraced 61.8% of 1.2583/1.2435 correction.

Series of higher highs and higher lows suggest that larger uptrend from 1.1802 (2023 low of Mar 8) remains intact, although more evidence would be required to confirm that bulls are back to play after correction.

However, near-term outlook is still unclear, as markets await releases of US private sector labor data (ADP) and Services PMI, ahead of key event – Fed rate decision, due later today, which are likely to provide clearer direction signals.

Today’s close above daily Tenkan-sen (1.2475) would keep alive slight bullish bias, with lift and close above 1.2550 (Fibo 76.4% of 1.2583/1.2435) to confirm and open way for retest of 2023 high (1.2583).

On the other hand, loss of daily Tenkan-sen would increase pressure and risk break of pivotal daily Kijun-sen (1.2429) which would open way for deeper correction.

Res: 1.2533; 1.2550; 1.2583; 1.2666

Sup: 1.2475; 1.2460; 1.2429; 1.2386