Close above 10DMA to signal that two-day pullback is over

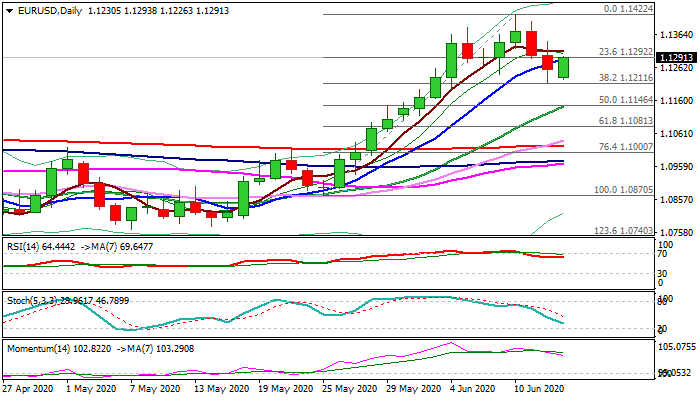

The Euro edged higher in early US session on Monday, after two-day fall was contained by key Fibo support at 1.1212 (38.2% of 1.0870/1.1422) on Friday and today’s action stays above correction low.

Larger uptrend remains intact and current easing so far looks like mild correction, but current bounce needs break and close above 10DMA (1.1286) to generate reversal signal.

On the other side, soured risk sentiment on fears of second way of coronavirus infection weighs along with falling daily momentum, which formed bearish divergence.

Loss of 1.1212 Fibo support would trigger further weakness for extended correction of 1.0870/1.1422 upleg.

Markets focus on today’s UK/EU Brexit talks, Tuesday’s German CPI data for fresh signals.

EU leaders summit (18/19 June) is one of key events this week, as talks about recovery fund are on agenda that could be supportive for Euro.

Res: 1.1311; 1.1340; 1.1403; 1.1422

Sup: 1.1212; 1.1166; 1.1140; 1.1081