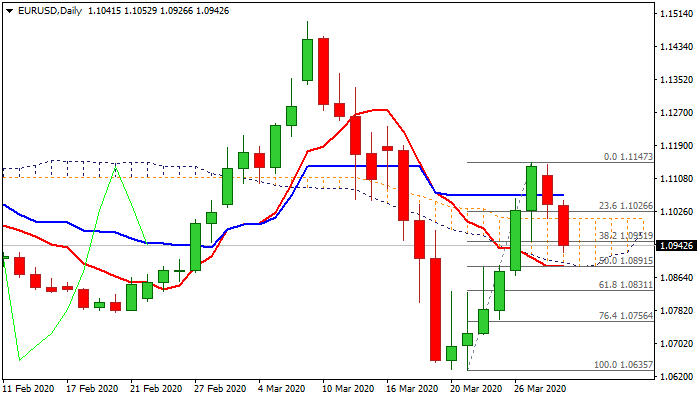

Close below key 1.0891 support would signal reversal

The Euro fell on Tuesday, extending the weakness of the previous day, pressured by increased demand for the US dollar at the end of month / quarter.

Monday’s bearish inside day was initial negative signal which materialized on today’s bearish acceleration through strong supports at 1.1008/00 (daily cloud top / psychological) and other pivot at 1.0951 (Fibo 38.2% of 1.0635/1.1147).

Fresh bears are also helped by rise of negative momentum on daily chart, as the price fell below a cluster of DMA’s (between 1.1078 and 1.1005) and stochastic emerged from overbought territory and heading south.

Close below 1.0951 Fibo support is needed for fresh bearish signal which will require confirmation on close below key 1.0891 level (daily cloud base / 50% of 1.0635/1.1147 / daily Tenkan-sen) and signal reversal.

Bearish bias is expected to stay intact while the action remains under. daily cloud top

Res: 1.0951; 1.1008; 1.1026; 1.1046

Sup: 1.0926; 1.0891; 1.0880; 1.0831