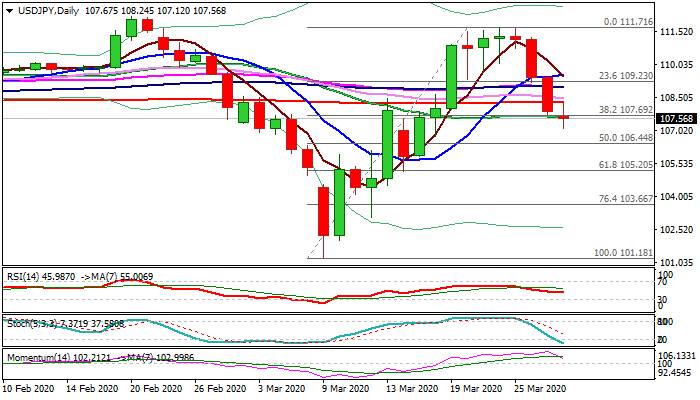

Close below key Fibo support and weekly cloud base to signal further weakness

Brief recovery in Asia after Thu/Fri strong fall was capped by broken 200DMA (108.30) and fresh weakness probes below key supports at 107.69 (Fibo 38.2% of 101.18/111.71 upleg) and 107.44 (weekly cloud base.

Strong loss of momentum on daily chart supports scenario but oversold stochastic warns of extended consolidation in the area of strong supports before fresh bears resume.

Close below 107.69/44 pivots would signal deeper pullback from 111.71 (24 Mar high) and expose support at 106.44 (50% retracement / daily Kijun-sen).

Only break and close above 200DMA would sideline bears and generate initial basing signal.

Res: 108.30; 108.48; 109.00; 109.23

Sup: 107.44; 107.12; 106.75; 106.44