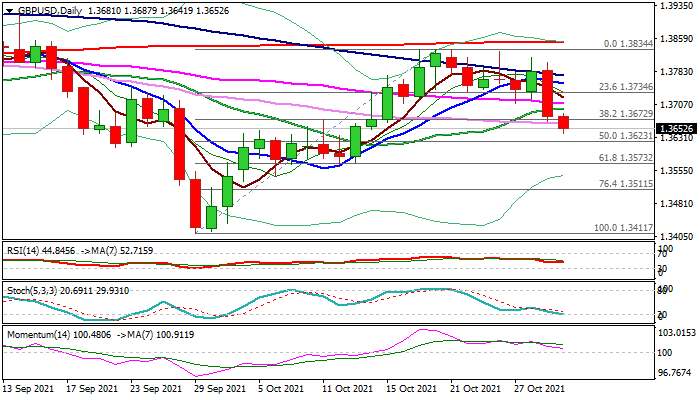

Close below key Fibo to confirm bearish signal and risk deeper fall

British pound remains firmly in red on Monday and dips to the lowest in nearly three weeks, in extension of Friday’s 0.8% fall (the biggest one-day drop since Sep 29).

Negative weekly close formed reversal pattern on weekly chart, following repeated failures to sustain break above the top of thick weekly cloud, while Friday’s drop and close below converging 20/55DMA’s) weakened near-term structure.

Fresh bearish signal was generated on today’s break below pivotal Fibo support at 1.3672 (38.2% of 1.3411/1.3834), reinforced by 30DMA, with close below here to strengthen bears for extension through 1.3623 (50% retracement) towards a higher base at 1.3570 zone (also Fibo 61.8% of 1.3411/1.3834).

Upticks should stay under 1.3700 zone (20/55DMA’s) now reverted to resistance, to keep bears in play.

Res: 1.3672; 1.3709; 1.3734; 1.3754

Sup: 1.3641; 1.3623; 1.3600; 1.3570