Conflicting data and studies keep near-term action neutral

The pair is holding in directionless mode on Monday (within the range of last Friday) as dollar was inflated by fresh risk appetite, but lira was also boosted by strong Turkey’s GDP data which showed that the economy returned to growth in Q3.

Conflicting data and daily indicators maintain neutral near-term stance and lacking direction signal.

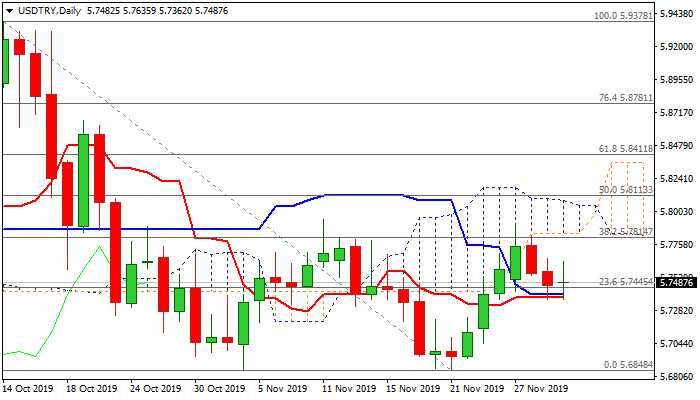

The downside is well supported by converged rising daily 10/200 DMA’s (5.7323/04), with daily cloud twist on Wednesday (5.8043) expected to attract.

On the other side, last week’s strong rally was continuously capped by the base of rising daily cloud, keeping bulls limited in attempts to break above daily cloud and confirm double-bottom pattern (5.6848).

Daily MA’s are in mixed setup, momentum and RSI are flat, while stochastic is negative.

Extension through daily cloud base (5.7842) and close above is needed for initial bullish signal, which would require confirmation on extension above cloud top (5.8076).

Conversely, break below 10/20DMA’s would bring bears in play and shift near-term focus lower.

Res: 5.7515; 5.7654; 5.7842; 5.8076

Sup: 5.7362; 5.7304; 5.7251; 5.7142