Conflicting news and neutral techs keep pound in sideways mode but risk of pullback exists

Cable is holding around 1.30 handle in early European trading on Monday, after starting the week with gap-higher and hitting session high at 1.3024.

The media report over the weekend about an all-UK customs deal, initially supported the pound but PM May’s office called it speculation and sterling lost traction.

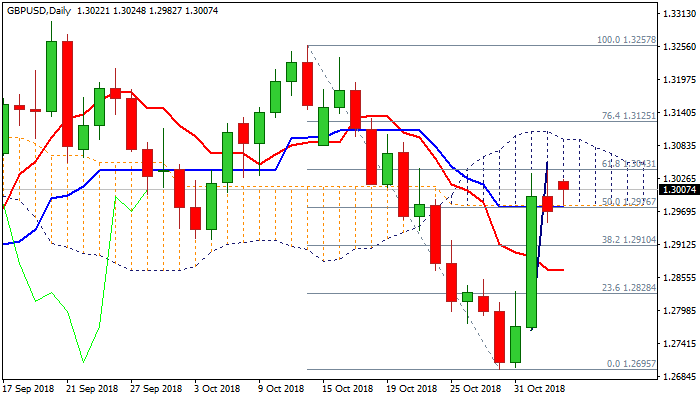

Risk of pullback exists after repeated rejection under Fibo barrier at 1.3043 (Fibo 61.8% of 1.3257/1.2695, reinforced by 100SMA) and Friday’s close in red and below daily cloud base, adds to negative signals.

Daily MA’s are in mixed setup and momentum in sideways mode signal neutral near-term mode, but the downside remains vulnerable.

Return and repeated close below daily cloud base (1.2980) would be negative signal for further easing, with extension below double-Fibo support at 1.2909/10 (38.2% of 1.2695/1.3040 / broken Fibo 38.2% of 1.3257/1.2695) needed to generate stronger reversal signal.

Conversely, initial bullish signal could be expected on eventual close above 1.3043 Fibo barrier, with extension and close above daily cloud (cloud top lays at 1.3095) to signal bullish continuation.

Res: 1.3024; 1.3043; 1.3095; 1.3125

Sup: 1.2980; 1.2951; 1.2921; 1.2909