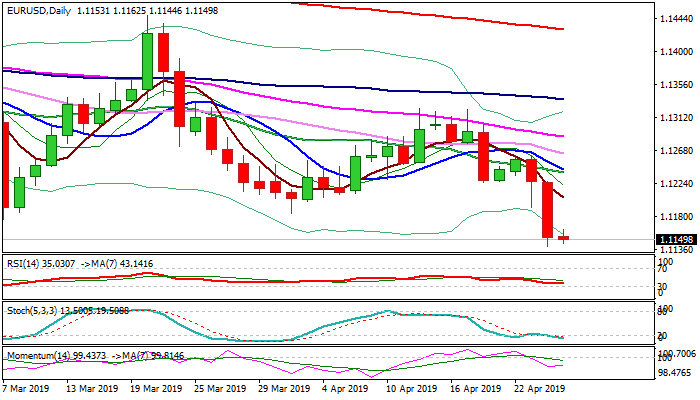

Consolidation after 0.66% fall to precede further weakness

The Euro remains in red and looks for retest of Wednesday’s low at 1.1140 (the lowest since mid-June 2017), posted after strong bearish acceleration which marked daily fall of 0.66%.

Wednesday’s break and eventual close below pivotal Fibo support at 1.1186 (61.8% of broader 1.0340/1.2555 uptrend) generated bearish signal, which requires confirmation on weekly close below 1.1186.

The Euro was hit by weaker than expected German Ifo data, but broadly higher dollar proved to be the main driver.

Bears eye target at 1.1118 (20 Jun 2017 low), violation of which would unmask psychological 1.10 support.

Profit-taking after strong fall and oversold conditions could spark consolidative / corrective action, with upticks seen as positioning for fresh downside and capped at 1.1200/20 zone.

Res: 1.1162; 1.1186; 1.1200; 1.1230

Sup: 1.1140; 1.1118; 1.1058; 1.1000