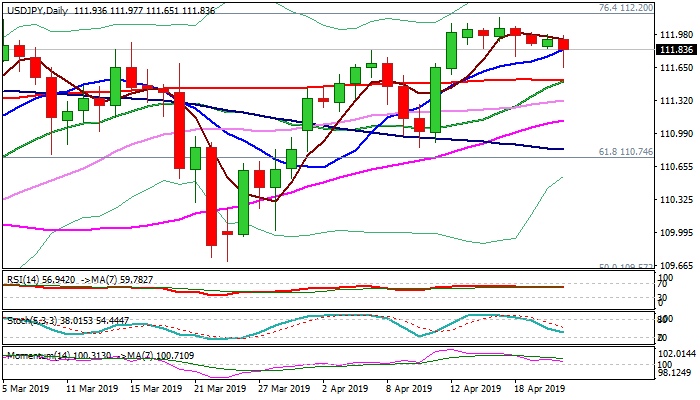

Converged 20/200SMA’s continue to strongly underpin near-term action

The pair recovered quickly from overnight’s drop to 111.65 and holding within tight range between 10SMA (111.83) and psychological 112 barrier in European trading on Tuesday.

Dip-buying after overnight’s selling by Japanese exporters, keeps broader bullish bias, with action being strongly underpinned by converged 20/200SMA’s (111.51), which attempt to for golden-cross.

Weaker daily momentum would reduce the pace of upside action, with extended consolidation seen as likely near-term scenario.

Only break below 20/200SMA’s would weaken the structure and risk deeper pullback.

US New Home sales are in focus today, but Friday’s release of US GDP data is seen as key event, which is expected to provide stronger direction signal.

Res: 112.00; 112.20; 112.60; 113.00

Sup: 111.65; 111.51; 111.31; 111.12