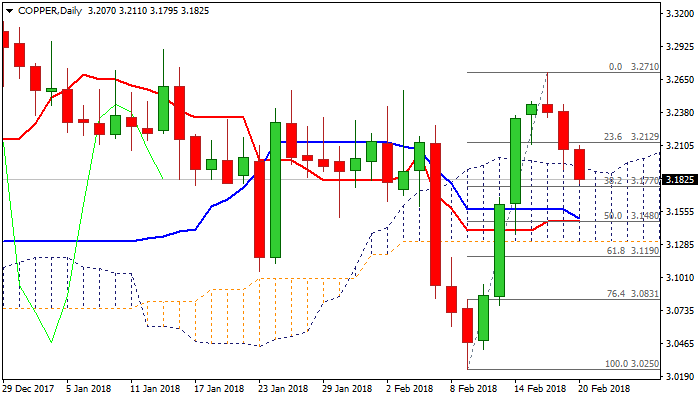

COPPER – bears penetrate daily cloud again, face a cluster of supports

Copper remains firmly in red on Tuesday, extending pullback from last Friday’s spike high at $3.2710 and probing again into thick daily cloud (spanned between $3.1935 and $3.1312) after false break through cloud top on Friday.

The metal is pressured by stronger dollar and could extend weakness further as slow stochastic reversed from overbought territory on daily chart and showing plenty of space at the downside, while bearish momentum is building.

Fresh weakness through cloud top ($3.1935) pressures next pivotal support at $3.1770 (Fibo 38.2% of $3.0250/$3.2710 rally), break of which would generate fresh bearish signal.

Further bearish extension would face a plethora of supports provided by daily MA’s, laying between $3.1787 and $3.1412, which are expected to be strong obstacle for bears.

Close below cloud top will be bearish signal and will be reinforced by close below Fibo support at at $3.1770.

Conversely, repeated failure to clearly penetrate daily cloud would signal extended hesitation and sideline immediate bearish threats.

Res: 3.1935; 3.2110; 3.2445; 3.2710

Sup: 3.1770; 3.1714; 3.1567; 3.1412