COPPER extends weakness below daily cloud on strong dollar

Copper remains in red for the fifth consecutive day and extends weakness on Thursday, hitting new lows of over two weeks at $3.10 zone.

The metal accelerated lower in Asia after mild recovery to $3.1460, as stronger than expected China’s Manufacturing data showed limited impact.

Strengthening dollar and lower prices of global stocks keeps copper price under increased pressure.

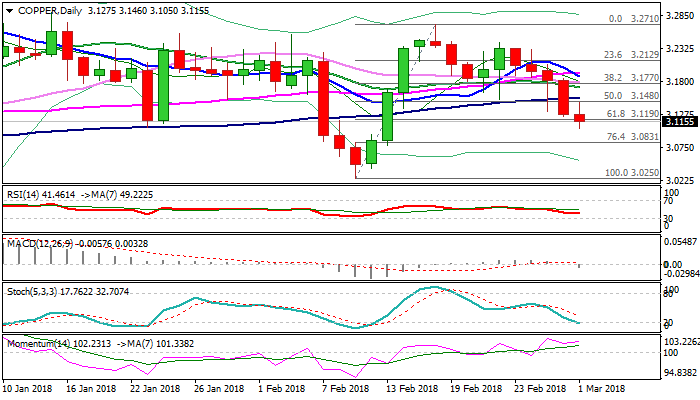

Today’s weakness broke below important supports at $3.1312 / $3.1190 (base of thick daily cloud / Fibo 61.8% of $3.0250/$3.2710 rally) with close below to generate strong bearish signal for extension towards $3.0831 (Fibo 76.4%).

Daily MA’s are in firm bearish setup, but 14-d momentum remains bullish and oversold slow stochastic could obstruct existing bears.

Broken cloud base should ideally cap, however, stronger upticks cannot be ruled out and broken 100SMA ($3.1537) is expected to limit and keep bearish bias intact.

Res: 3.1190; 3.1312; 3.1537; 3.1705

Sup: 3.1050; 3.0831; 3.0780; 3.0415