Copper hit new one-year low on rising fears of trade war escalation

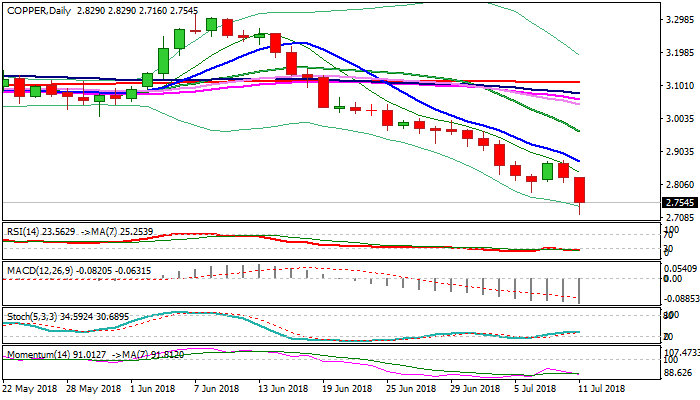

Copper price holds in steep descend from $3.3140 (07 June high), which accelerated today after announcement that the US would impose further tariffs on Chinese goods.

Extended weakness hit new one-year low at $2.7160, after bearish signal was generated on today’s extension below $2.7876 (Fibo 38.2% of $1.9360/$3.3140 rally), with daily close below needed to confirm fresh bearish signal.

A double-top pattern ($3.3200/$3.3140) boosted bears which eye target at $2.6250 (Fibo 50%) and could extend towards strong support at $2.4720 (07 May trough), reinforced by Fibo 61.8% of $1.9360/$3.3140 at $2.4624.

Strong bearish setup is helped by growing negative sentiment on fears that escalation of trade war may significantly reduce demand for the metal, keeping Copper’s price under strong pressure.

Meanwhile, bears may take a breather in coming sessions as daily studies are overextended, but upticks should be limited by falling 10SMA (currently at $2.8761) to keep bears intact.

Res: 2.7876; 2.8000; 2.8290; 2.8761

Sup: 2.7160; 2.7000; 2.6585; 2.6250