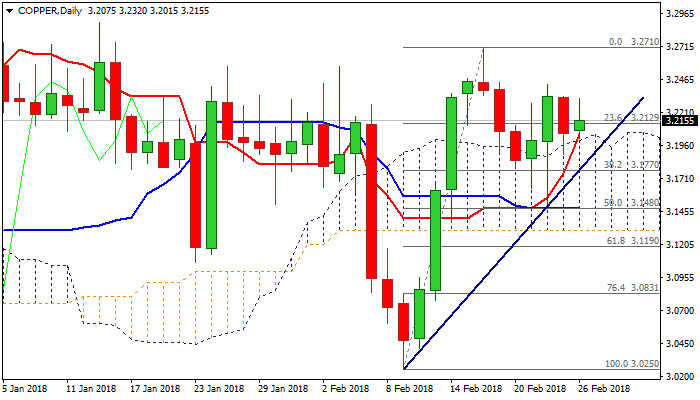

COPPER jumps on bullish fundamentals but mixed techs limit the advance for now

Copper edged higher on Monday, driven by weaker dollar and reports that imports of base metals to China jumped in January, but the rally showed signs of stall, short of last Fri/Thu highs at $3.2335 and $3.2425, keeping the upside limited for now.

Daily MA’s are in bullish setup and supportive, with near-term action being supported by thick daily cloud (cloud top lies at $3.2000), but weakening momentum studies (14-d momentum is attempting into negative territory) partially offsets positive signals.

The metal may hold in extended consolidation between cloud top and Thu’s high) which could keep in play positive bias for stretch towards $3.2710 (16 Feb lower top).

Conversely, penetration and close in the cloud would weaken near-term structure and turn immediate risk to the downside.

Cracked Fibo 38.2% of $3.0250/$3.2710 at $3.1770 marks next support, loss of which would generate stronger bearish signal.

Res: 3.2320; 3.2425; 3.2504; 3.2710

Sup: 3.2000; 3.1890; 3.1770; 3.1630