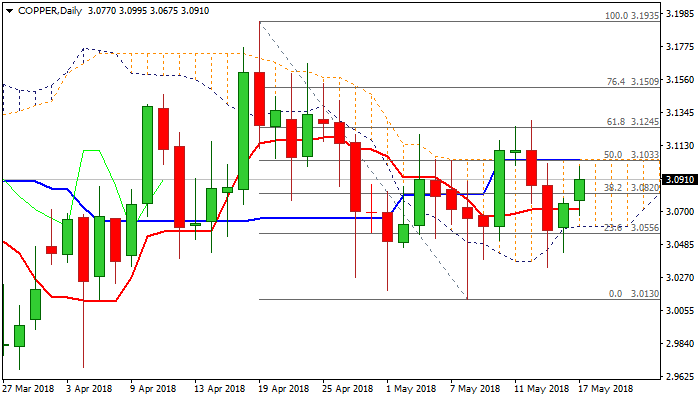

COPPER – recovery attempts face strong headwinds from daily cloud top barrier

Copper extended recovery into second straight day on Thursday, but gains faced strong headwinds from significant barrier at $3.1033 (daily cloud top / Kijun-sen).

Price pulled back on fresh strength of the US dollar and concerns about weaker demand from China – metal’s top world consumer.

Signals from daily chart are mixed as strong bullish momentum supports the advance, but the price was so far unable to break above a cluster of daily MA’s between $3.0840 and $3.0986 and today’s advance capped by 200SMA.

Risk of deeper pullback would persist while near-term price action holds below 200SMA / daily cloud top.

Boundaries of daily cloud are key, as close above cloud top would generate bullish signal for extension towards next strong barriers at $3.1245 (Fibo 61.8% of $3.1935/$3.0130) and $3.1295 (14 May high).

Conversely, return and close below daily cloud would weaken near-term structure for retest of $3.0335 (15 May low) and possible extension towards $3.0130 (08 May spike low).

Res: 3.0986; 3.1033; 3.1245; 3.1295

Sup: 3.0820; 3.0675; 3.0605; 3.0430