Corrective action struggles at 200SMA; negative fundamentals weigh on sentiment

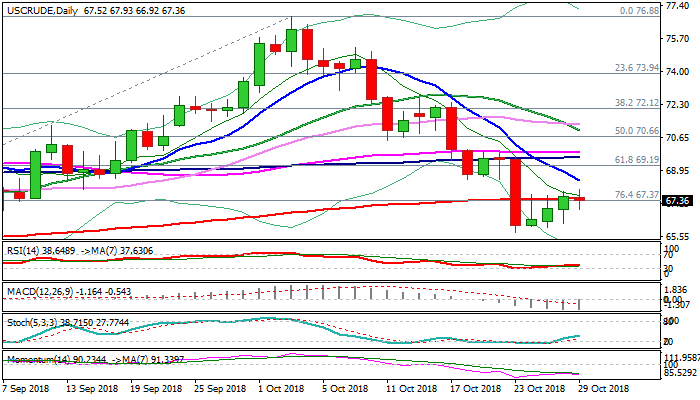

Three-day recovery rally from new nine-week low at $65.73 (23 Oct) shows initial of stall on approach to daily cloud base ($68.11) and lacks momentum to sustain break above 200SMA ($67.49), following Friday’s marginal close above it, after two repeated failures on Wed/Thu.

Daily techs remain bearish and show broader downtrend from $76.88 (03 Oct) intact, with corrective action seen as positioning for fresh weakness.

Falling 10SMA ($68.43) is expected to cap extended upticks and keep bearish structure intact.

Crude oil remains under strong pressure on concerns about slowing global growth, signaled by fall in global stocks and rise of dollar on safe-haven buying.

Also, persisting concerns about US/China trade conflict and signals that top oil producers would maintain output once Iran is out on sanctions, keep oil price in negative mode, for final push towards target at $64.43 (16 Aug low).

Break and close above pivot at $68.43 (falling 10SMA) would sideline immediate bears, but lift above daily cloud (spanned between $68.11 and $68.97) is needed to signal stronger correction.

Res: 67.93; 68.11; 68.97; 69.60

Sup: 66.92; 66.18; 65.73; 64.84