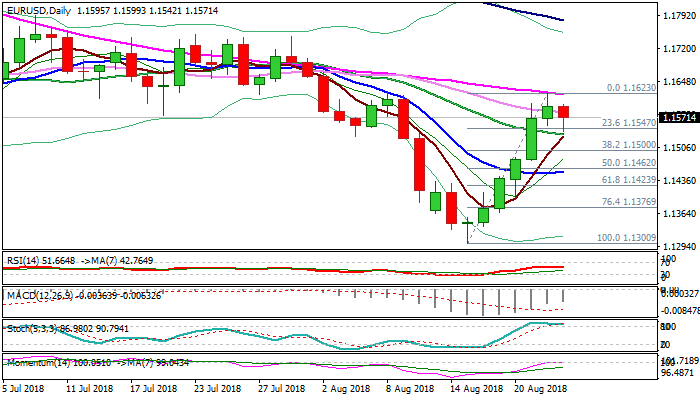

Corrective dips seen as positioning for fresh upside while broken 10SMA holds

The Euro stands at the back foot in early Thursday’s trading, pressured by stronger dollar after hawkish Fed and initial signs of stall of recent strong five-day rally.

Near-term bulls showed strong rejection at falling 55SMA, which marks key barrier, with rising risk of deeper pullback.

Slow stochastic reversed and created bear-cross, on the way to emerge from overbought territory, while 14-d momentum is returning to negative zone, supporting negative near-term scenario.

Solid support at 1.1530 (20SMA) stays intact for now, with deeper pullback needed to hold above 10SMA (1.1454) to keep bullish near-term bias in play for fresh attempts higher.

Sustained break above 55SMA (1.1621) would unmask lower platform at 1.1750.

Conversely, close below 10SMA would signal reversal and lower top at 1.1623 (Wednesday’s recovery peak).

Res: 1.1599; 1.1623; 1.1640; 1.1687

Sup: 1.1542; 1.1530; 1.1500; 1.1454