Crude oil prices rise on dominating supply factor

WTI oil price rose around $1.5 a barrel in European trading on Wednesday, as concerns about tight supply ahead of winter season sidelined worries of weaker demand on economic slowdown in the US and Europe.

Signals that the US economy is likely heading towards a soft landing eased downside pressure and added support to oil prices, also offsetting negative signal from unexpected and strong rise in US crude stockpiles (API report).

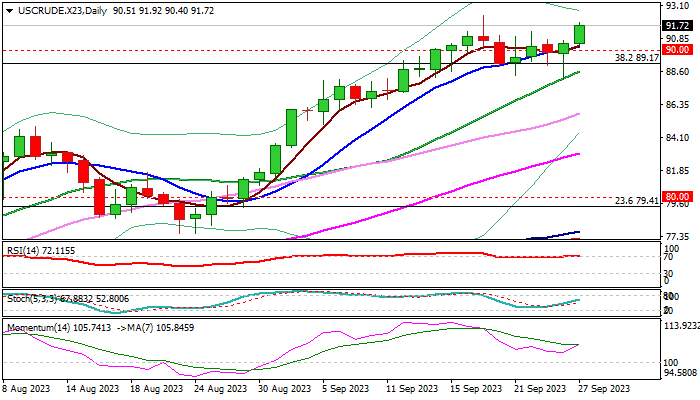

Fresh strength is focusing target at $92.40 (new 2023 high posted on Sep 19), break of which would signal continuation of a larger uptrend, which paused for shallow consolidation.

Initial target lays at $93.72 (Nov 7 high), ahead of $97.06 (50% retracement of $130.48/$63.63 downtrend) and psychological $100 barrier, expected to come in focus on stronger bullish acceleration.

Daily studies returned to full bullish setup after shallow pullback from $92.40 peak was contained by rising 20DMA and left a bear trap under broken Fibo 38.2% ($89.17).

Res: 92.40; 93.72; 94.00; 95.02

Sup: 91.31; 90.40; 90.00; 89.17