Crude oil rises over 5% to new 8-month high

WTI oil price surged over 5% today and hit the highest since early March, lifted by strong optimism on coronavirus vaccine and beginning of transition of power in the White House.

Fresh risk sentiment boosts hopes of stronger demand recovery which stalled on new wave of virus and significant contraction of global economy, offsetting negative impact from surging new cases and high mortality.

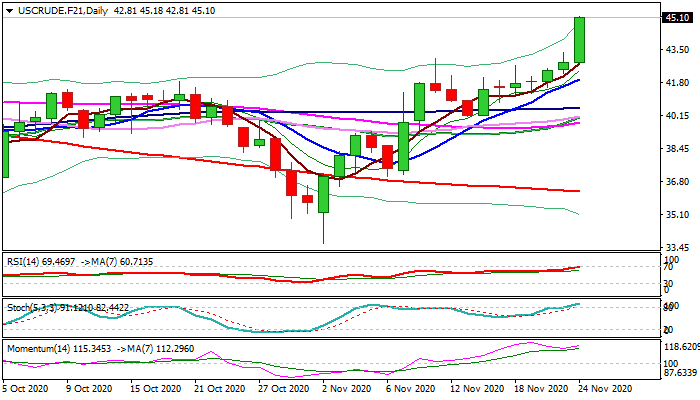

Bulls accelerated through key barriers at $43.05/75 (Fibo 61.8% of $65.63/$6.52 drop / post-pandemic recovery top) and probe above $45 level, eyeing Fibo projections at $46.14 (123.6%) and $47.62 (138.2% projection of rally from $33.61, Nov 2 low), with psychological $50 barrier expected to come in focus.

Bullish techs on daily and weekly charts support the action but overbought conditions warn of corrective actions which are expected to offer better opportunities to re-enter bullish market.

Eventual close above $43.05 pivot after several failures, is needed to confirm strong bullish stance.

Traders also eye releases of US crude inventories which could additionally boost bulls if crude stocks fall.

Res: 46.14; 47.00; 47.62; 48.53

Sup: 44.50; 44.00; 43.75; 43.05