Current correction seen as positioning as gold remains top safe-haven asset

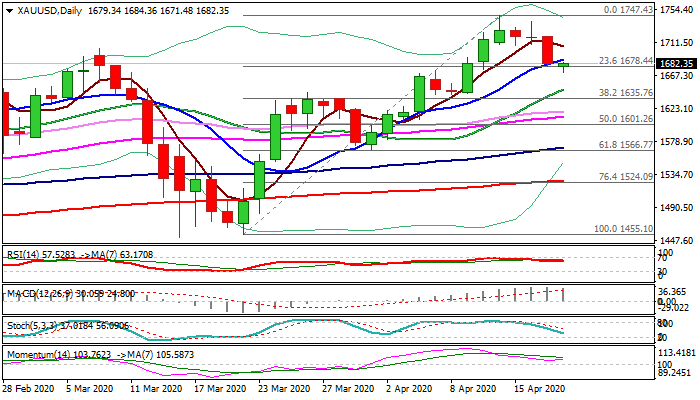

Spot gold edged lower on Monday despite fading risk sentiment and hit one-week low but so far unable to clearly break pivotal double-Fibo support at $1678 (23.6% $1455/$1747 and 38.2% of $1567/$1747).

Overall picture remains bullish with current pullback from new nearly eight-year high ($1747, posted on 14 Apr) seen as positioning ahead of fresh push higher.

The yellow metal maintains its top safe-haven appeal during current strong uncertainty over the depth of damage coronavirus lockdown caused to global economy.

Corrective action should be ideally contained at $1678 zone, however deeper dips towards next key supports at $1647 (20DMA); $1641 (8 Apr higher low) and $1635 (Fibo 38.2% of $1455/$1747) cannot be ruled out before bulls regain traction.

Caution on clear break of $1635 pivot that would put bulls on hold for deeper correction.

Res: 1684; 1688; 1691; 1695

Sup: 1678; 1671; 1647; 1635