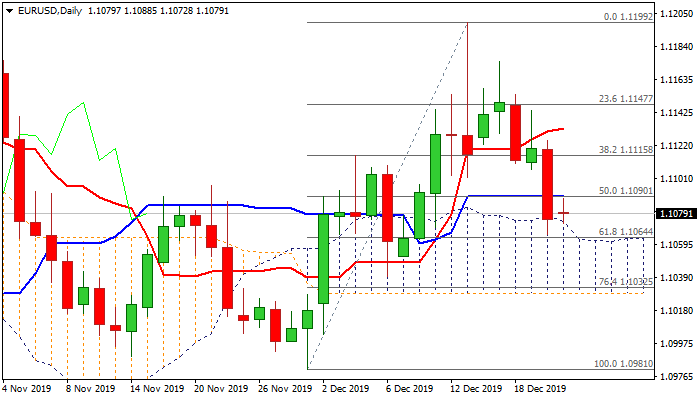

Daily cloud top contains for now but near-term outlook remains negative

The Euro is trading within narrow consolidation between daily cloud top (1.1074) and daily Kijun-sen (1.1090) on Monday, lacking signals in thinning pe-holiday market.

Strong fall on Friday was contained by daily cloud top and nearby pivotal Fibo support at 1.1064 (61.8% of 1.0981/1.1199), but big bearish daily candle weighs heavily and keep bias with bears.

Flat daily momentum and RSI contribute to current indecision, which may extend as markets started to slowdown ahead of holidays.

Bearish signal could be expected on firm break below cloud top / Fibo support that would open way for extension towards daily cloud base (1.1029).

Lift above daily Kijun-sen would provide relief, but extension above 1.1115/32 (broken Fibo 38.2% / daily Tenkan-sen) would be required for reversal signal.

Res: 1.1090; 1.1115; 1.1132; 1.1144

Sup: 1.1074; 1.1064; 1.1029; 1.1002