Daily cloud top continues to cap as bulls fail to capitalize from Brexit extension

Sterling holds in a choppy mode on Thursday and so far, unable to advance despite optimism on sidelined fears of no-deal Brexit and EU’s approval for extension of Brexit day until 31 Oct.

Most of possible scenarios remain on the table as extension gives UK lawmakers time to work on existing plan until agreement but could also cancel Brexit or ask for new referendum.

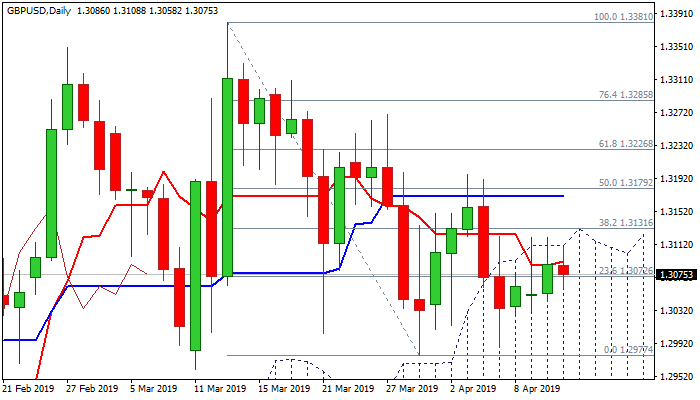

Cable remains at familiar levels for the third straight day, with price action being repeatedly capped by daily cloud top (1.3110) which marks key barrier.

Strong upside rejections in past two days weigh and repeated failure to eventually break above cloud would keep pound at the back foot and shift near-term risk lower.

Bearish momentum on daily chart supports scenario, along with 20/30SMA’s (1.3135/45) which turned south and diverge, but fresh bears would look for more evidence on final close below trendline support (1.3050) that would unmask key 200SMA support (1.2975).

Conversely, close above daily cloud would generate initial bullish signal which needs confirmation on break above pivotal barriers at 1.3131/45 zone (Fibo 38.2% of 1.3381/1.2977/ 20/30SMA’s).

Res: 1.3079; 1.3094; 1.3110; 1.3131

Sup: 1.3050; 1.3025; 1.3000; 1.2975