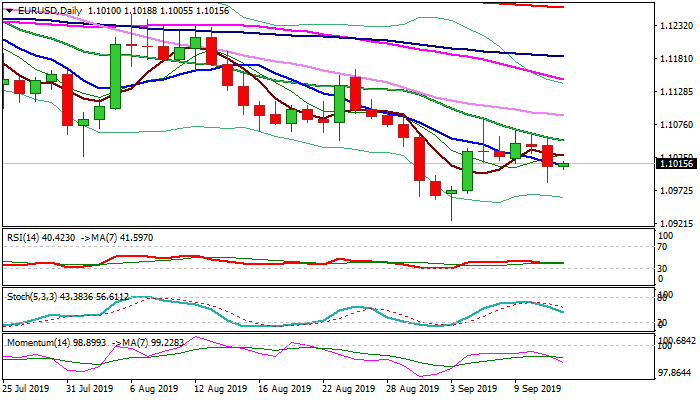

Daily studies are bearish but ECB is expected to define near-term direction

The Euro is holding within narrow range around 1.10 handle in pre-ECB’s trading on Thursday.

Wednesday’s dip to 1.0985 (though bears failed to close below cracked psychological 1.10 support) weakened near-term structure, but lacking confirmation of reversal.

Daily techs are in bearish configuration and supportive further weakness, but ECB’s decision is expected to give clearer signal.

The central bank is widely expected to cut rates today, with focus on fresh stimulus, as one of bank’s key tools in boosting bloc’s weakening economy.

President Mario Draghi, in one of his last big events before handing over the leadership to Christine Lagarde in October, will have a number of policy instruments available in attempts to prevent / reduce negative impact from internal (weakening EU economy; Germany at high risk of falling into recession; inflation expectations sliding) and external (major global central banks are easing; US/China trade war; Brexit) factors.

The Euro may come under increased pressure on scenario of rate cut and surprise with restarting asset purchases, but disappointing size of the stimulus package may inflate the single currency and prevent stronger fall.

Pivotal supports lay at 1.10 and 1.0986 (Fibo 61.8% of 1.0925/1.1084 upleg), while falling 20DMA (1.1051) and 1.1085 (5 Sep spike high) mark upper triggers.

Res: 1.1023; 1.1051; 1.1067; 1.1084

Sup: 1.1000; 1.0986; 1.0963; 1.0925